What are the Best 12 Basic Features of Health Insurance?

- Introduction

- Now let us try to know all the basic features of health insurance one by one and how they work.

- a) Room Types- Shared Room, Single Pvt AC Room and Any Room

- b) Pre-Post Hospitalisation

- c) Day Care Treatment

- d) Domiciliary Hospitalisation

- e) Road Ambulance Cover

- f) Air Ambulance Cover

- g) Organ Donor Expenses

- h) Reload / Recharge of Sum Insured

- i) Alternative Medical Treatment (AYUSH)

- j) Mental Illness Hospitalisation

- k) Obesity Treatment

- l) Modern / Advanced Treatment

Introduction

Health Insurance means that whenever a medical emergency occurs, it protects us from financial loss. Is it like that? Yes, but it is not so and it is so, always keep one thing in mind as much as it is important to buy health insurance, it is more important than that how it works to know about Basic Features of Health Insurance and its products/plans have features and benefits that work. How to do it, what is the eligibility, etc.

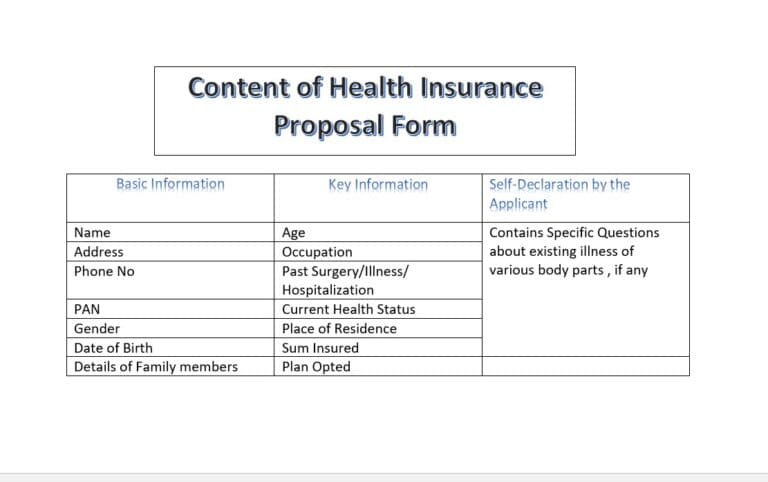

- I. Coverage- Sum insured and coverage types like Family Floater, Individual and Multi-Individual.

- II. ELIGIBILITY- Minimum age of entry – 91 days (Child) and 18 years (Adult), Maximum age at entry – varies from plan to plan, Relationship Cover- Family Floater (Self, Spouse, Kids up to 4 vary from plan to plan, Parents / Parents in Law it will vary from Plan to plan, Relationship cover – Multi-Individual -Self, spouse, son, daughter, brother, sister, grandson, granddaughter, son-in-law, daughter-in-law, brother-in-law, sister-in-law, nephew, niece. (Depending upon plan to plan),

- III. BASIC COVER- Basic cover in health insurance is the cover that is in-built into it (Plan), for this there is no need to pay anything extra to the insurance company, list of some important basic covers.

a.Room Types- Shared Room, Single Pvt AC Room and Any Room

b. Pre-Post Hospitalization

c. Day Care Treatment

d. Domiciliary Hospitalization

e. Road Ambulance Cover

f. Air Ambulance Cover

g. Organ Donor Expenses

h. Reload / Recharge of Sum Insured

i. Alternative Medical Treatment (AYUSH)

j. Mental Illness Hospitalization

k. Obesity Treatment

l. Modern / Advanced Treatment

Now let us try to know all the basic features of health insurance one by one and how they work.

a) Room Types– Shared Room, Single Pvt AC Room and Any Room

These are very important features in Health Insurance, the entire cost of any treatment depends on the Room Category, let us understand this with an example like Dr Mehta. The hospital pays them Rs 1000 for each shared room visit. Dr Mehta pays Rs 2000 for a single Pvt room and Rs 5000 for a luxury room, similarly, the category of the room can also increase or decrease the cost of any treatment. You always have to know about your In the plan, I have to check which room is given in my health insurance policy and go to the hospital accordingly. If you wish to go to an upgraded room, you will have to pay a co-payment (proportionate).

b) Pre-Post Hospitalisation

This terminology is very popular in health insurance how much pre-post, what does it mean and how does it work? For any treatment for which you are admitted for more than 24 hours if some OPD expenses have already been incurred for the same treatment, then it is called Pre Hospitalization Expenses and if after discharge from the hospital, some OPD expenses related to the same treatment. are incurred. If there are expenses then the same can also be claimed, keep in mind that Pre-Post can always be claimed in the form of reimbursement only.

c) Day Care Treatment

There are many such medical treatment procedures for which there is no need for 24-hour hospitalization in the hospital and there is a condition of at least 24-hour hospitalization for the claim, but whatever procedures day care treatment is required, This condition does not apply to those who come under the age of 15, some examples are Dialysis, Angiography, Chemotherapy, Cataract, Piles/Fistula, Hydrocele, Sinusitis etc. (There is a separate article on this also).

d) Domiciliary Hospitalisation

There are some conditions that have to be fulfilled such as the treatment should continue for at least 3 consecutive days, if it is not possible to admit the patient to the hospital or if there is no bed available in the hospital then the claim can be made under domiciliary hospitalisation. can do. There are some exceptions in this and we cannot claim them under Domiciliary Hospitalisation, such as Asthma, bronchitis, tonsillitis and upper respiratory tract infection including laryngitis and pharyngitis, cough and cold, influenza, Arthritis, gout and rheumatism, Chronic nephritis and nephritic. syndrome, Diarrhea and all types of dysenteries, including gastroenteritis, Diabetes mellitus and insipidus, Epilepsy, hypertension, Psychiatric or psychosomatic disorders of all kinds, Pyrexia of unknown origin. Then whenever you want to get treatment under these features, definitely check whether the procedures are covered or not.

e) Road Ambulance Cover

In case of a Medical Emergency, the insured is given a claim for a road ambulance in the nearest hospital, in many plans some payable amount is fixed, while in some it is up to the sum insured but the condition is that Road Ambulance should be from Network hospital. If there is no arrangement to perform some special medical procedures in the treating hospital, then in this situation also you will get a claim for whatever ambulance is required from one hospital to another. One thing that should always be kept in mind is that the insured does not get ambulance cover from the hospital to his home.

f) Air Ambulance Cover

This facility is now provided by almost all Standalone Health Insurance companies, some also provide the facility of International air ambulance, you should also check this while taking health insurance.

g) Organ Donor Expenses

It sounds as if the claim of the Organ Donor is also given but it is not 100% true, whatever expenses are incurred in the procedures of Organ Harvesting are claimed, not of the Organ. One thing that should always be kept in mind here is that Organ Trade is Illegal in India and it should also fulfil all the conditions of the Transplantation of Human Organs Act 1994. Now this includes donor screening tests, post-hospitalization of the donor and if there are any medical complications at the time of harvesting or even after that, then the claim is not available.

h) Reload / Recharge of Sum Insured

Reload means going after the sum insured again, but it increases only up to the basic sum insured. In this, many companies also put a condition that the benefits of reload are not applicable to the “same person, same year and same disease”. You also have to check whether the Base SI should be 100% complete or not. Many health insurance companies do not have this condition, so definitely check this before taking the policy.

i) Alternative Medical Treatment (AYUSH)

Apart from Allopathy Treatment, the cover is given for some other alternative treatments in Health Insurance Plans, which are covered under AYUSH (A-Ayurveda, Y-Yoga, U-Unani, S- Siddha and H- Homeopathy) These five types of treatments are covered, many health insurance companies provide cover for at least 24 hours of hospitalization while some also provide cover for OPD. You also have to keep in mind that many companies put limits or sublimits on it, that is, no matter what your sum insured is, they put limits on it like 25 thousand, 50 thousand etc. Whereas some companies also provide cover-up to the insurance amount.

j) Mental Illness Hospitalisation

Substantial disorder of thinking, mood, perception, orientation or memory that comprehensively impairs judgment, behaviour, the ability to recognize reality or the ability to meet the normal demands of life, mental states, covers is done. Also note that some circumstances are not covered, such as those that are not medically significant, such as anxiety, bereavement, relationship or educational problems, acculturation difficulties, or work pressures.

k) Obesity Treatment

i.e. surgery to reduce obesity, but there are some conditions in this such as the age of the insured person should be at least 18 years, Bariatric Surgery should be under the complete guidelines of its specialist doctor, BMI 40 or more. Yes, in some special circumstances, depending on the BMI, Bariatric Surgery can be done even at 35. Such as in obesity-related cardiomyopathy, in coronary artery disease, in severe sleeping disorder, in uncontrolled type II diabetes.

l) Modern / Advanced Treatment

There are 12 types of Modern Treatment covered in all the health insurance plans, you can see complete information about it on my blog, how it works and under what circumstances it is covered.

I hope that you have got a lot of information from this article, for similar informative and awareness information, subscribe to our blog and share it as much as possible.

Your suggestion is very important for us so that we can keep making our article more useful and informative, we request you to give your suggestion.

Disclaimer This is for informational purposes only. This information does not constitute medical advice or diagnosis