Niva bupa reassre 2.0 vs HDFC Optima Secure vs Care Supreme vs Aditya Birla Active One Max- Complete Comparision

| Sr. No | Features & Benefits | Niva Bupa Re.Assure 2.0 (Titanium Plus) | HDFC Optima Secure | Care Supreme | Adita Birla Activ One Max |

| 1 | Entry Age Adults | 18 years to 65 Years | Minimum 18 Years & To Any Age | Minimum 18 Years & Any Age | 18 years to Any Age |

| 2 | Entry Age Child | 91 Days to 30 Years & Min 5 Years for Individual | 91 Days to 25 years | 91 Days to 25 years | 91 Days to 25 Years & Min 5 Years for Individual |

| 3 | Policy Type | Individual /Multi-Individual & Family Floater | Individual /Multi-Individual & Family Floater | Individual /Multi-Individual & Family Floater | Individual /Multi-Individual & Family Floater |

| 4 | Tenure | 1/2/3 Years | 1/2/3 Years | One years | 1/2/3 Years |

| 5 | Family Definition | Sel+Spouse and 4 Dependents Children upto 25 Years | 2 Adults + 3 Kids | 2 Adults + 2 Kids | Sel+Spouse and 4 Dependents Childs upto 25 Years |

| 6 | Premium Type | Age Banded and Lock the Clock | Self+Spouse and 5 Dependents Children up to 30 Years | Age band and year band premiums will vary | Self+Spouse and 5 Dependents, Children up to 30 Years |

| 7 | Premium Zones | Zone -2 : Metro & Non-Metro | Zone -2 : Metro & Non-Metro | Zone I, II, III & IV | Zone I, II & III |

| 8 | Relationship Cover | Self, spouse, mother, father, mother-in-law, father-in-law, son, daughter, employer, employee | 2 Adults & 4 Kids, Self, legally married spouse OR live-in partner (same or opposite sex), dependent Children (Natural/legally adopted) | Self, spouse/live-in partner/same sex partner, son, daughter, father, mother, mother-in-law, father-in law, grand father, grand mother | Self, Legally Married Spouse OR Live-in Partner (Same Or Opposite Sex),Son, Daughter, Brother, Sister, Grandson, Granddaughter, Son in-Law, Daughter-in-Law,Brother-in-Law, Sister-in-Law, Nephew, Niece, Parents and Parents-in-Law |

| 9 | Basic Sum Insured | 10 Lakh to 1 Cr | 10 Lakh to 2 Cr | 7 Lakh to 25 Lakh | 10 Lakh to 2 Cr |

| 10 | Room Type | Single Pvt Room & Shared Room | Any Room, Single Pvt AC Room & Shared Room | Any Room, Single Pvt AC Room & Shared Room | Any Room, Single Pvt AC Room & Shared Room |

| 11 | Shared Accommodation Benefit | Up to Rs.15 Lakh Base Sum Insured: Rs.800 per day; Maximum Rs.4,800 & Above 15 lakh Base Sum Insured Rs.1000 per Day; Maximum Rs.6000 | Not Available | Not Available | Not Available |

| 12 | ICU Charges | Up to the Sum Insured | Up to the Sum Insured | Up to the Sum Insured | Up to the Sum Insured |

| 13 | Ambulance | Road Ambulance: Up to Sum Insured, Air Ambulance: up to Rs. 2.5 Lakh per hospitalization | Up to the Sum Insured , 5 Lakh for Air Ambulance | Up to the Sum Insured, 5 lakh but in optional cover | Actuals up to Sum Insured, Air Ambulance not available |

| 14 | Day Care Treatment | Up to the Sum Insured | Up to the Sum Insured | Up to the Sum Insured | Up to the Sum Insured |

| 15 | Modern Procedures / Treatments | Covered up to Sum Insured with a sub-limit of Rs.1 Lakh per claim on a few robotic surgeries, for listed Modern Treatment | Up to the Sum Insured | Up to the Sum Insured | Up to the Sum Insured |

| 16 | HIV / AIDS and STD Cover | Not Cover | Up to the Sum Insured | Not Cover | Up to the Sum Insured |

| 17 | Mental Illness Hospitalization | Up to the Sum Insured | Up to the Sum Insured | Up to the Sum Insured | Up to the Sum Insured |

| 18 | Obesity Treatment | Up to the Sum Insured | Up to the Sum Insured | Up to the Sum Insured | Up to the Sum Insured |

| 19 | Pre-Hospitalization Expenses | 60 Days up to Sum Insured | 90 Days up to Sum Insured | 60 Days up to Sum Insured | 90 Days up to Sum Insured |

| 20 | Post-Hospitalization Expenses | 180 Days up to Sum Insured | 180 Days up to Sum Insured | 180 Days up to Sum Insured | 180 Days up to Sum Insured |

| 21 | Domiciliary- Hospitalization | Up to the Sum Insured | Up to the Sum Insured | Up to the Sum Insured | Up to the Sum Insured |

| 22 | Home Health Care | Up to the Sum Insured | Up to the Sum Insured | Up to the Sum Insured | Up to the Sum Insured |

| 23 | AYUSH Treatment | Up to the Sum Insured | Up to the Sum Insured | Up to the Sum Insured | Up to the Sum Insured |

| 24 | Organ Donor Expenses | Up to the Sum Insured only for Harvesting | Up to the Sum Insured only for Harvesting | Up to the Sum Insured only for Harvesting | Up to the Sum Insured only for Harvesting |

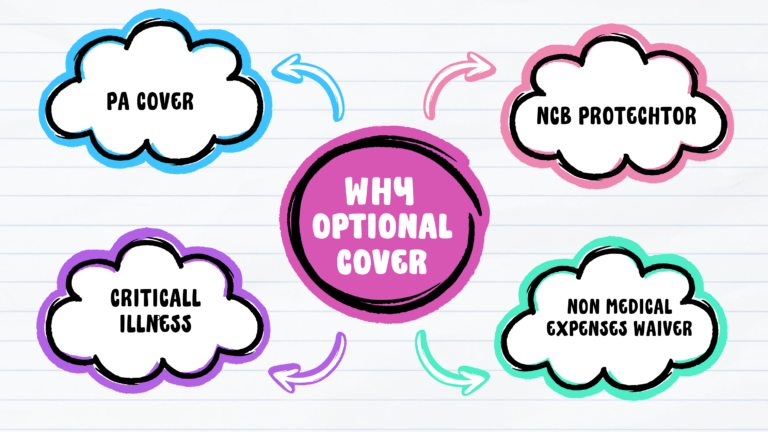

| 25 | Annual Health Check-up | For a defined list of tests; up to Rs.500 for every Rs.1 Lakh Base Sum Insured; (Individual: Maximum Irs. 5,000 per Insured; Family Floater: Maximum Rs. 10,000 per policy). | Family Floater policies limits will be for 5 Lakh SI Rs.2500, 10 Lakh SI Rs. 5000, 15 Lakh SI Rs. 8000, for 20,25 and 50 Lakh SI Rs. 10000 and 1 Cr & 2 Cr SI Rs. 15000 per policy year after 1st renewal of the policy, only on Reimbursement basis | Once for all Insured every policy year but in Optional Cover Only | (Listed & Cashless) |

| 26 | ReAssureX/ Super Reload/Reload/Recharge | Unlimited times Claim will be paid up to the Base Sum Insured and the rest will be carried forward | As an Optional Cover, if opted will work 2X of Base Sum Insured from 1st Claim | Available for unlimited times | Unlimited times the Claim will be paid up to the Base Sum Insured and the rest will not be carried forward |

| 27 | Booster+/ Super Credit/NCB | 10X: Unutilized Base Sum Insured carries forward to the next policy year, a maximum of up to 10 times | 100% upto 400% | Cumulative Bonus (NCB) 50% upto 100% In Buit but adding Optional Cover NCB Super Up to 100% of SI per year, Max up to 500% of Sum Insured Note: Shall not reduce in case of claim total Sum Insured after 5th Renewal is 7th Times of Base Sum Insured | 6X: Unutilized Base Sum Insured carries forward to the next policy year, a maximum of up to 6 times |

| 28 | Live Healthy- Renewal Discount / Health Returns | Up to 30% discount on premium at the time of Renewal. | Not Available | Upto 30% but in Optional Cover | Up to 100% discount on net premium at the time of Renewal. |

| 29 | Second Medical Opinion | Once in a policy year for Any Conditions | Once in a policy year for Any Conditions | Not Available | Once in a policy year for Any Conditions |

| 30 | E-consultation | Unlimited e-consultation within our network | Unlimited e-consultation within our network | Unlimited e-consultation within our network | Unlimited e-consultation within our network |

| 31 | Pre-Existing Waiting Period | 36 Months | 36 Months | 36 Months | 36 Months |

| 32 | Specific Surgeries Waiting Periods | 24 Months | 24 Months | 24 Months | 24 Months |

| 33 | Lifestyle Medical Conditions waiting periods | As per the Pre-Existing Waiting Period | As per the Pre-Existing Waiting Period | As per the Pre-Existing Waiting Period | From Day 1 Coverage for IPD for Asthma, BP, Cholesterol, Diabetic |

| 34 | Non Medical Expenses Waiver/Consumables Waiver | As per Listed Annexure | Only Annexure A is Covered | Coverage of expense related to 68 Non-payable items during Hospitalization, but in Optional Cover | As per Listed Annexure, I, II, III & IV |

| 35 | Claim Ratio it will changes per Quarter Ref. The Economic Times Article DT 21st March 2025 | 92.02% | 99.16% (Including Non Health) | 92.77% | 92.97% |

| 36 | Real Claim Experience (On Practicle Profeesional Experience) | Moderate to High | High | Moderate | Moderate to High |

| 37 | Re-Consideration Claim Acceptance | Low | Very Low | Moderate | Moderate to High |

| 38 | Pros | 10X Coverage & “Lock the Clock” Features | High Claim Settlement Ratio | 7X Coverage | 6X Coverage and Facility to earn 100% Net Premium and policy will be renew only with GST(HealthReturns) |

| 39 | Cons | Capping on Robotic Surgeries | Too High Premium | Multiple Benefits only on Optional Basis, which pay extra premiums | Sometimes technical glitches due to mutiple services offer by Partners |

| 40 | Premium Range | Competitive | High | Competitive | Competitive |

| 41 |