Top 10 difference between individual health insurance and group health insurance.

How often do we hear from a prospective client that I have passed the health insurance of the company, I have coverage of lakhs and all the members of the family are covered, then what is the need for individual health insurance?

That’s great if your company has provided your health insurance coverage, but it is very important to have your health insurance as well. In this article, you will get to know that along with the company’s health insurance, you also have your cover too.

- You have company health insurance only as long as you are employed, not after that.

- In today’s lifestyle, no one knows what will happen to whom and when, if you do research you will know what diseases are occurring in people. https://awarenessgyan.com/understanding-the-critical-illness-plans/

- In this corporate world, once you become medically unfit, the management removes you from your position.

- In this situation you are stuck, now there is no job, no health and no health insurance. Then, what is left?

- Do you think that any health insurance company will give you health insurance or not? Answer is NO

It’s now clear that individual health insurance is the most important need in today’s scenarios, now there are some important differences between group health and individual health insurance, which are as follows:-

1. Product terms and conditions –

The terms and conditions are predefined in individual policies and are customised in group health policies.

2. Rate –

In individual policies, the rates are defined on the chart (exceptional – –loading tables), whereas in group health insurance the rates are negotiable.

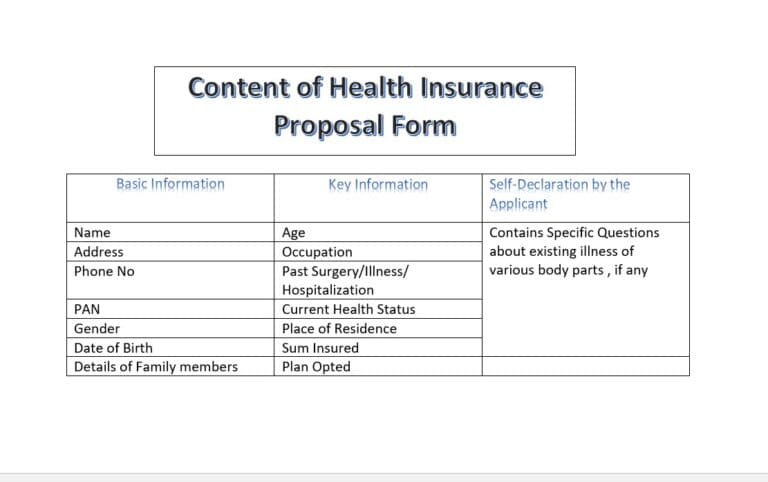

3. Medical Examination –

In an individual policy, a medical examination may or may not be required as per age, medical history and sum insured whereas in group health insurance, a medical examination may or may not be required.

4. Underwriting –

In individual policy health insurance companies can deny, accept or accept with some condition or waiting periods or both, but in group health insurance it can be accepted and completely tailor-made based on mutual agreement with the applicant and the insurer.

5. Insurance Coverage –

When we compare the coverage of group and individual policies, once the sum insured (Base+NCB+SNCB+Reload) in the individual policy is exhausted, there is no possibility of getting any additional coverage whereas in group health insurance, the group size increases. The facility of “Corporate Buffer” is available to increase insurance coverage.

6. Premium Revision –

In individual policies, the premium rate is revised either by changing the age bracket, by changing it every year, or by revising the rate of the overall product, whereas in group health insurance policies, the premium remains as per the claim ratio.

7. Policy Types –

Individual or retail policy is one type in which the proposer owns the policy while group health insurance is of two types, one to the Employee- Employer and the other by agreeing with the NBFC or Bank Insurance Company, group health insurance is given to its customer in which Ownership rights belong to NBFC/Bank.

8. Ownership Transfer –

In individual health insurance policy transfer of ownership is easy, anyone with an eligible age and relationship can be a proposer or change at a later stage is possible, whereas in group health insurance ownership is always Bank/NBFC or Corporate which has taken cover for its employees. it remains with them only.

9. Risk Factor –

In Individual policy, you can renew for a lifetime no matter how many claims you have in your policy, whereas, in Group health insurance, you cannot renew as soon as the agreement between the Insurance Company and Bank/NBFC ends. In addition, if the insured person suffers from any serious illness then any kind of policy cannot be covered in future, which is a huge negative side of group health insurance.

10. Additional Benefits –

There are some restrictions for additional Benefits like PED Waiting periods, Specific surgery/procedures waiting periods, and maternity coverage these are usually not included in individual policies whereas as per agreement between the insurer and the applicant, these can be covered by day one

Disclaimer this information is based on experience and reading of III Books