Content of Health Insurance Proposal Form- An Introduction & Its Importance

A health insurance policy is a legal contract between the insurer and the insured person and every health insurance contract is valid for 365 days, however, you can pay the premium for 2 years and 3 years and will get a discount from the insurer of up to 10% per year premium. And will be renewed for a lifetime.

Here we can explain how health insurance policies are contracts, rather than popularly known as health insurance policies, a contract needs to qualify the following elements: –

Mandatory Elements

- Offer and Acceptance

- Consideration

- Capacity to Contract

- Legality of form

Offer and Acceptance–

health insurance policies offer insured persons the benefits of providing coverage against hospitalization per the terms and conditions mentioned in the policy wording and table of benefits. in the offer, the proposer (applicant) seeks the coverage, on the other hand, the insurer will evaluate the risk and decide whether to accept or reject.

Consideration–

the premium of the insurance policy will be determined by the insurer based on the relevant inputs provided by the applicant, e.g. age, health, lifestyle habits, family size and the sum insured

Capacity to Contract-

a health insurance policy is a contract between the insured person and the insurer, hence both should be legally capable of entering into a contract, so any minor cannot be the proposer

Legality of form–

When an applicant buys a health insurance policy, means he/she is signing the legal contract, with all relevant declarations, regarding their health, previous medical history, lifestyle habits etc and accordingly the insurer is liable to pay the claim as per the terms and conditions. of health insurance policy (Contract)

Insurance Contract Vs Other Contract

It is extraordinary that while buying health insurance, the applicant is not made aware of all the terms & conditions, permanent exclusions, what will be covered, and even if it is written in the policy wording, it is mentioned in very legal language, that isn’t easy to understand by the common public. Unlike other contracts, the insurance applicant cannot see the complete contract unless a health insurance policy is issued

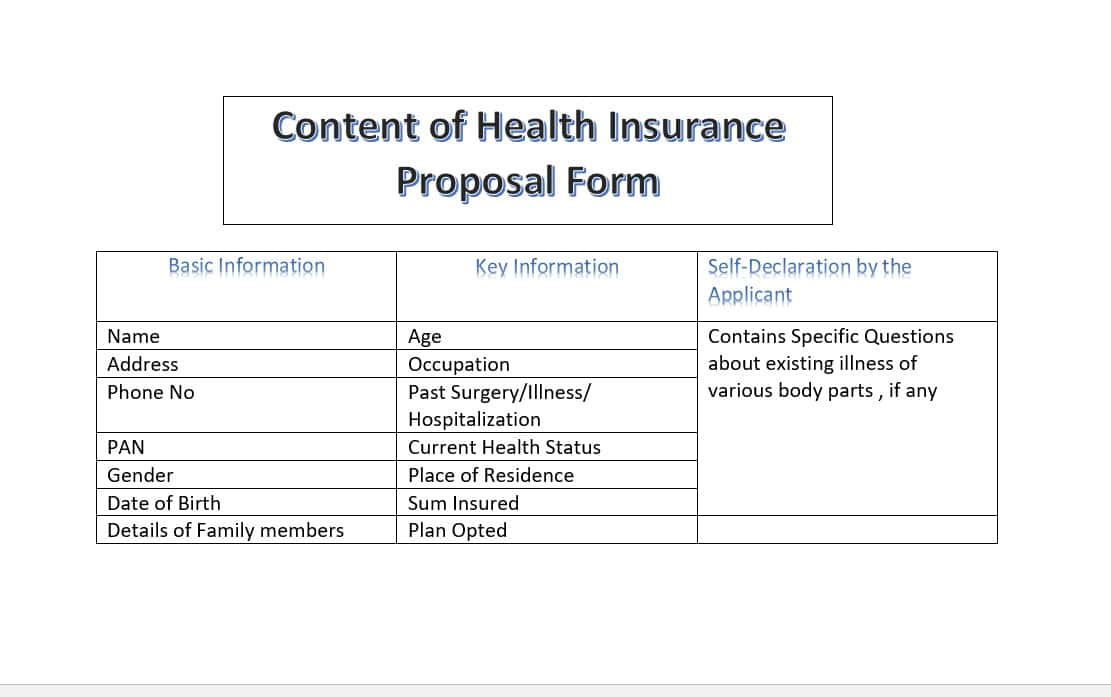

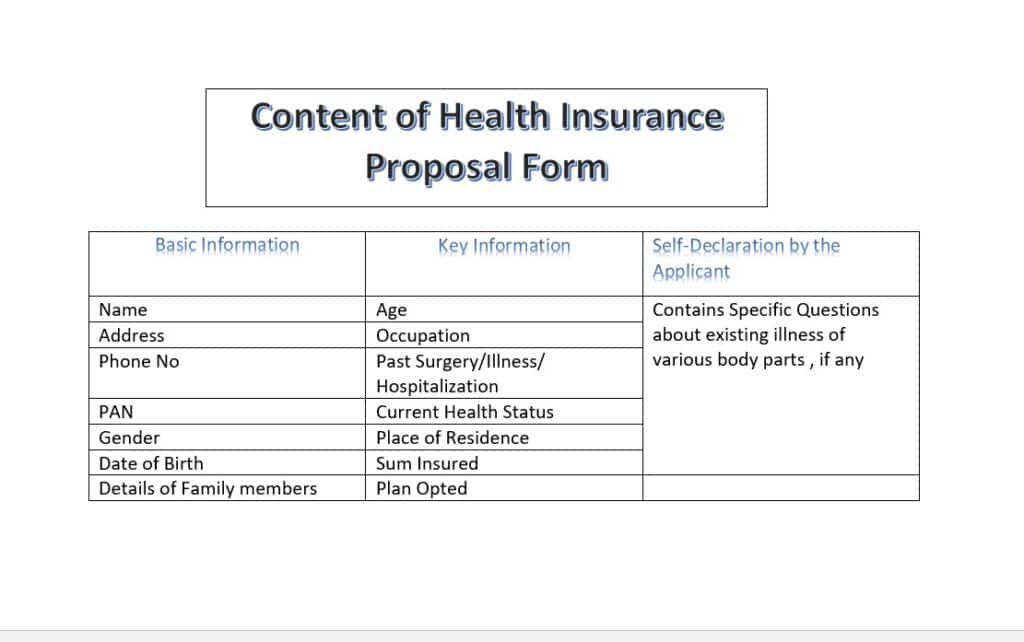

Health Insurance Proposal Forms – proposal forms consist of major two types of information. First is “Details of the Applicants and the second is Declaration by the Applicant.

- Name of the applicant

- Date of Birth

- Gender

- Occupation

- Sum Insured/ Plan Applied

- Communication Address & Contact Details

- Permanent Account Number

- Details of the Hospitalization/Illness/ disease at Present or in past if any

- If the applicant applied for Family Floater or other members of the family, then details of all members including past illness or medical conditions

- All member’s Height and weight

A question arises in the mind of many people why so many details are required to get health insurance, all this information is as important for the insurer company as it is for the applicant.

For Insurance Companies–

Following KYC Norms as prescribed by the regulator, accurately estimating Claim Probability, Doing Marketing Research, Providing relevant information for the Industry etc.

For Applicant –

By giving correct and complete information, the insured person is assured that no claim will be rejected in the future. Given non-disclosure, by giving correct information one does not need to remember anything, about the hospital There is no risk of any mismatch between the information I gave to the treating doctor and the information given to the insurance company at the time of taking the policy.

Self-Declaration of the applicant for health –

Even after submitting this information, the applicant must go through a medical underwriting process as the insurer assesses your health risk, including body parts and if any disease has developed, such as neurological, mental, High BP, Cardiovascular, diabetic, HIV, STD etc. The main reason to ask so many questions rather than asking a single question that any medical history or not that records the facts, is to enable the customer to think through various diseases so that he can provide further information if any, just to remind works.

Contact Us for more Information: Click Here