Top 5 Maternity Health Insurance Plans in India in 2024

Top 5 health Insurance plans in India, in which insurance companies offers maternity benefits as well. There will be waiting periods, Limits and Sub-Limits

Top 5 health Insurance plans in India, in which insurance companies offers maternity benefits as well. There will be waiting periods, Limits and Sub-Limits

An introduction of Pre-Post Hospitalisation features of health insurance in India

In Health Insurance there is multiple types of surgeries and Pre-Existing Disease having some waiting period that prevent poliholder do not claim without of these waiting periods and eveyone should know this, without of this information Hospital will make huge bills and it will be paid by the policyholders own pockets

In this article covered all the terminology related to health insurance

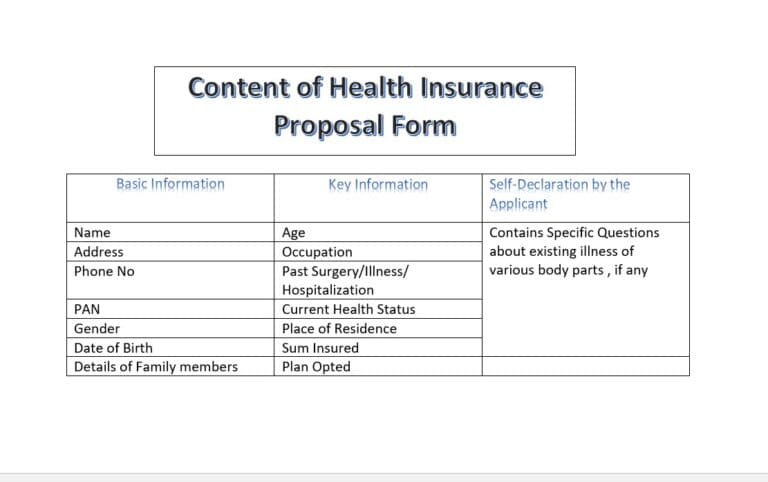

In this article, a brief and simple introduction about health insurance information sharing by applicant to insurer and the basis of these information, insurer evaluate the applicant risk and will decide the policy terms and conditions, about pre-existing illness, current health status and permanent exclusion, waiting periods etc.,

Here is the information that every person belonging to the health insurance industry (Insured Person, Agents, Hospital, Sales Managers even insurance company branch customer care managers), does not know completely about this information gap, this article is very informative and you all get to know that what is the main and generic reason for health insurance claim rejections

In this article, you have been informed that some specific medical procedures are covered by health insurance after 24 months and you have also been informed that what is the probability of these specific surgeries in India.

Here is the common assumption that there’s no need for fixed benefits insurance plans like critical illness, look at the scenario a term life insurance will come into the picture when an insured person death, an indemnity health insurance plan comes into the picture when an medical emergency happens, a personal accident policy come to the picture when an accident happens but we are not getting such huge monetary benefits and the answer is “Critical Illness” it comes in the picture whenever insured person gets diagnosed with Critical Illness and the insured person gets fully paid as monetary benefits, please read this article completely and you get to know , how Critical Illness plan works

In this article, we got to know that what is the main 10 differences between individual health insurance and group health insurance, why we need to have individual health insurance plan, whether we have group health insurance provided by corporations

It is a myth that if you have indemnity health insurance and term life insurance in your portfolio, those will be enough and there is no further insurance product, but wait a while, Personal Accident policy should be in your portfolio too, the main reason behind this is PA policy will cover your liabilities where are indemnity health insurance cover your emergency medical expenses and term life insurance cover the compensation of death, but this product will not offer the lumpsum cash …please read this article completely and you get to know that ……

“This article, explains why the reimbursement claim activity is necessary in health insurance, the complete checklist”

This article has explained all the basic features which you always see in health insurance product brochures, but in general, the common public feels that it is very technical, given that, all these have been explained simply. it has been said

In this article, important clauses in health insurance have been explained in simple words.

In this article you got to know, how many modern / advanced treatments cover in health insurance in India what will the estimated cost and how it covers

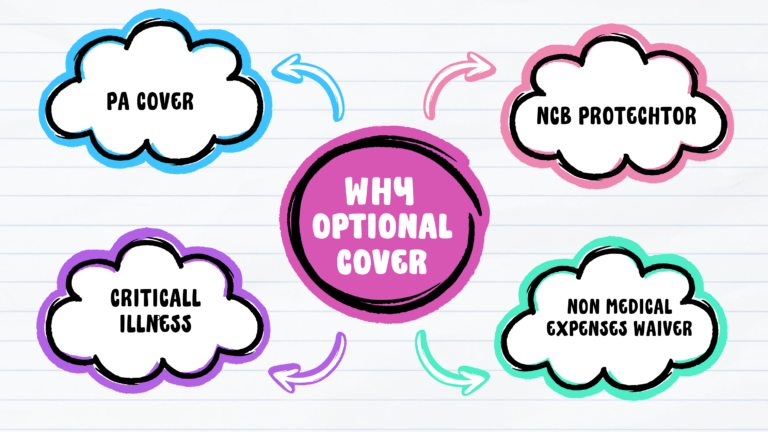

In this article, all you get to know that how Optional Cover Features in Indemnity health Insurance product what optional covers need to opt and what not

Not only from the insured person’s perspective but also from the insurance fraternity need to know what the permanent exclusion in indemnity health insurance plans, this article its is explains that all these medical conditions will not be covered in health insurance